The Wisconsin 30 Index is an equal-weighted stock index that is updated annually on December 31.

The index was originally constructed to reflect the 30 largest Wisconsin stocks based on market capitalization as of 12/31/21. The index is rebalanced on an annual basis to reflect year-end market capitalizations. Returns prior to 12/31/21 are based on 12/31/21 constituents looking backward, with adjustments if a name did not exist in earlier periods.

The reports linked on this website were developed by students in the Lubar College of Business Investment Management Certificate Program under the supervision of faculty.*

Wisconsin 30 Companies

Listed in order of market value as of December 31, 2021

| Ticker | Company | Market Value (Millions) | Analysis |

| FISV | Fiserv, Inc. | 68,525 | Report |

| ROK | Rockwell Automation, Inc. | 40,471 | Report |

| WEC | Wisconsin Energy Group, Inc. | 30,619 | Report |

| GNRC | Generac Holdings Inc. | 22,203 | Report |

| LNT | Alliant Energy Corp. | 15,390 | Report |

| AOS | A.O. Smith Corporation | 13,664 | Report |

| EXAS | Exact Sciences Corporation | 13,412 | Report |

| RRS | Regal Rexnord Corporation | 11,531 | n/a |

| SNA | Snap-On Incorporated | 11,530 | Report |

| OSK | Oshkosh Corp. | 7,606 | Report |

| KSS | Kohl’s Corporation | 6,873 | n/a |

| HOG | Harley-Davidson, Inc. | 5,800 | Report |

| MAN | ManpowerGroup Inc. | 5,279 | Report |

| SNDR | Schneider National, Inc. Class B | 4,781 | Report |

| MTG | MGIC Investment Corporation | 4,619 | n/a |

| ZWS | Zurn Water Solutions Corp. | 4,417 | n/a |

| SPB | Spectrum Brands Holdings, Inc. | 4,326 | Report |

| SXT | Sensient Technologies Corp. | 4,205 | Report |

| DOC | Physicians Realty Trust | 4,148 | n/a |

| APAM | Artisan Partners Asset Management, Inc. Class A | 3,765 | Report |

| ASB | Associated Banc-Corp | 3,390 | Report |

| BMI | Badger Meter, Inc. | 3,117 | Report |

| MGEE | MGE Energy, Inc. | 2,974 | Report |

| BRC | Brady Corporation Class A | 2,794 | Report |

| PLXS | Plexus Corp. | 2,686 | Report |

| MRTN | Marten Transport, Ltd. | 1,423 | Report |

| EPAC | Enerpac Tool Group Corp. Class A | 1,223 | Report |

| NIC | Nicolet Bankshares, Inc. | 1,200 | Report |

| FATH | Fathom Digital Manufacturing Corporation Class A | 1,076 | n/a |

| JOUT | Johnson Outdoors Inc. Class A | 939 | Report |

Index Details:

Contact

Dr. G. Kevin Spellman, CFA

David O. Nicholas Director of Investment Management

Senior Lecturer, Finance

Lubar Hall S442

608-334-2110

spellman@uwm.edu

*Disclaimer: The University of Wisconsin-Milwaukee is not a registered investment, legal, or tax advisor or broker/dealer. This work was completed by students in the Investment Management Certificate program in UWM’s Lubar College of Business under faculty supervision. All investment/financial opinions expressed are from their research and are intended as educational material. Although best efforts are made to ensure that all information is accurate and up to date, occasional unintended errors or misprints may occur.

Outlook

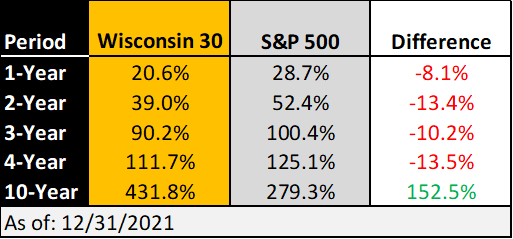

The Wisconsin 30 Index has outperformed the S&P 500 over the last 10 years, but it has underperformed more recently.

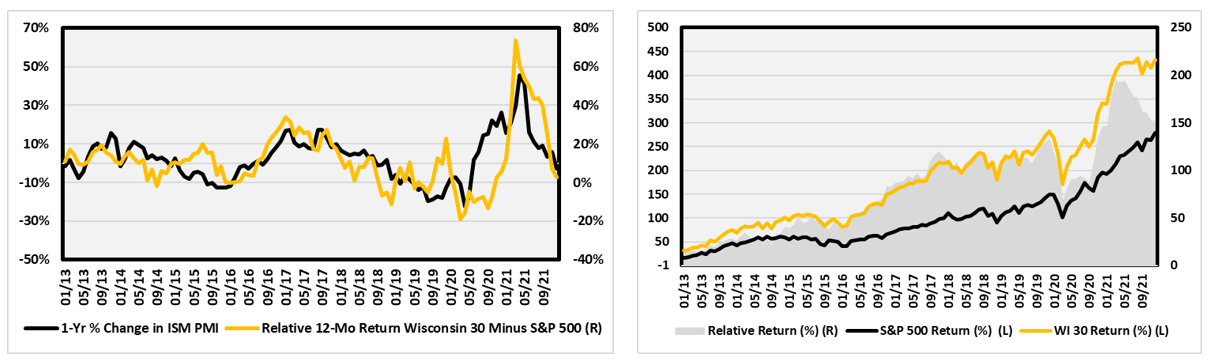

The equal-weight Wisconsin 30 Index has smaller and more economically sensitive companies than the S&P 500, so changes in the Institute for Supply Management’s PMI index have a large impact on returns. The PMI index is a survey of manufacturers on growth. The graph highlights the annual change in PMI (or acceleration of deceleration of growth) and returns of the Wisconsin 30 Index versus the S&P 500. As goes the economy, goes the Wisconsin 30 Index.

Performance

The Wisconsin 30 index underperformed the S&P 500 on a 1-, 2-, 3-, and 5-year basis, but outperformed over 10 years.

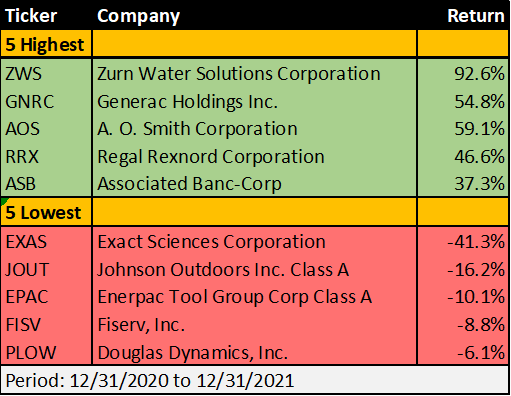

Top/Bottom Performers

Here are the best and worst performing Wisconsin 30 index stocks for the 12 months ending 12/31/21.

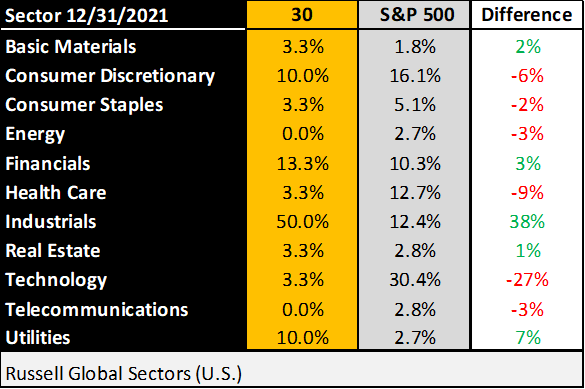

Sector Weights

The Wisconsin 30 index is massively overweight industrials and massively underweight healthcare and technology.

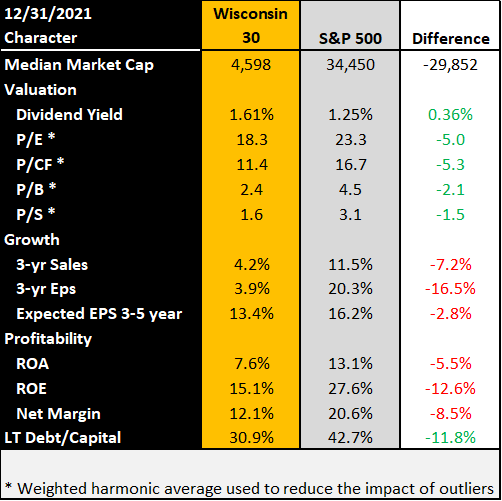

Characteristics

The Wisconsin 30 Index has smaller companies than the S&P 500.

They are less expensive than the overall market, but they have lower sales growth and profitability.