If you’re fascinated by how individuals and organizations grow wealth through investment portfolios, the Investment Management Certificate Program will challenge you with an intense, extended, applied educational opportunity.

As an IMCP student, you’ll carry out all of the duties that professional investors do – leaving the program with analyst-level skills. You learn the role of the sell-side analyst, buy-side analyst, investment banker, performance and risk manager, institutional sales, financial planner, and portfolio manager.

You will:

- Be part of a team that works on around $10 million in real portfolios

- Be trained in a Chartered Financial Analyst (CFA) Institute University Affiliation Program (undergraduate IMCP curriculum) where you are prepared for and encouraged to sit for the CFA Level I examination

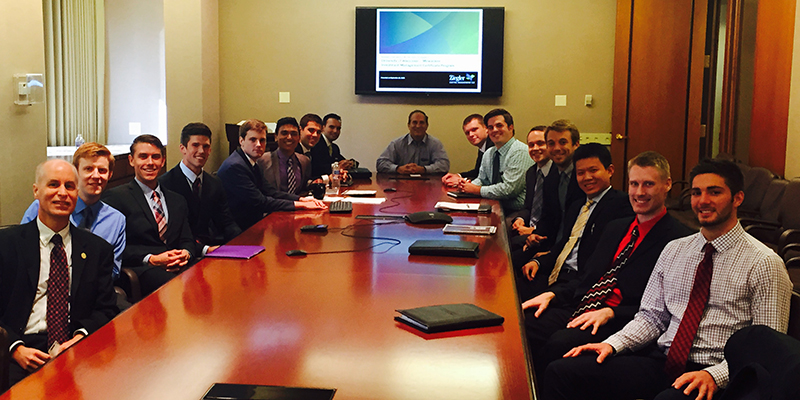

- Meet regularly with investment professionals inside and outside of the classroom

- Have access to top flight investment analytical tools

- Work on real projects and participate in competitions

- Travel to some of the world’s largest financial centers

Scholarships are available to IMCP students to support tuition and IMCP-related travel expenses, and for CFA examination fees.

Contact

Dr. G. Kevin Spellman, CFA

David O. Nicholas Director of Investment Management

Senior Lecturer, Finance

Lubar Hall S442

608-334-2110

spellman@uwm.edu

David O. Nicholas Applied Finance Lab

The Nicholas Applied Finance Lab (established through a generous $2.5 million gift from David O. Nicholas, President of Nicholas Company, who is a 1987 graduate of the Lubar College’s graduate program in finance) gives students hands-on access to leading-edge analytical software, research and data — the same tools that professional money managers use.

Analytical Resources include:

- Axioma

- Bloomberg

- Credit Suisse Holt Lens

- FactSet

- Interactive Brokers

- ISS EVA Investor Express

- Northfield

- think-cell

Research Resources include:

- Bank Credit Analyst

- Cornerstone Macro

- CreditSights

- Evercore International Strategy & Investment Group

- Fundamental Research Corp.

- JP Morgan

- The Leuthold Group

- Merrill Lynch

- Morgan Stanley

- Morningstar

- Robert W. Baird

- Sidoti & Company

- Standard & Poor’s

- Stifel Nicolaus

- Topdown Charts

- Trahan Macro Research

- UBS

Data Provided by:

- FTSE Russell

- Standard & Poor’s

$10 Million in Portfolios

IMCP students work on portfolios of over $10 million in assets and form three teams to manage internal funds. Our students have sole discretion for the internally managed portfolios, subject to “doing their homework” on securities and following an investment policy and portfolio construction specifics. They hold multiple meetings each year with a group of professional investors who represent a sophisticated “client.” At these client meetings, each portfolio team presents its philosophy and process, investment strategy, portfolio performance and risk, portfolio evolution, and on a security which reflect its approach to investing.

Professional Connections

Students meet regularly with investment professionals during and outside of class for discussion of the funds, markets, and other topics. Many dozens of top investment professionals generously commit their time each year as mentors, guest speakers, IMCP Advisory Council members, corporate visit hosts, business project providers, and in other capacities. Students also have access to the IMCP alumni network, which holds an annual Milwaukee Brewers tailgate event.

Internships and Careers

The summer between the first and second years of the program is the ideal time for students to engage in professional internships and/or projects in investments, financial analysis, financial planning, and other investment- and corporate-related roles. The program will help to facilitate connections and prepare students for the rigorous interview process. IMCP graduates will have a substantial competitive edge in pursuing careers post-graduation as investment analysts, financial analysts, investment advisors, investment bankers, credit analysts, and other roles in finance. Our alumni work in investment firms, major banks, research firms, corporations, and government organizations around the country.

Each year, many firms hire from the IMCP. Some are local, others national, some international, and some local with a national or international presence. Large firms such as Baird, Northwestern Mutual, and Wells Fargo hire IMCP graduates most years. Alumni also hold positions with top-ranked, sell-side analysts (including Institutional Investor Magazine Hall of Fame investment strategist Francois Trahan), and have gone to firms such as Goldman Sachs, UBS, and Citigroup. These are all great organizations, but so are other firms and smaller organizations where you may have much opportunity to learn a more diversified set of skills and perhaps make an even larger impact.

Investment Trip

There is nothing equivalent to learning about investments from investment professionals at their offices in some of the top financial centers — including Chicago, New York, and London. The IMCP’s Chicago trip allows students to meet with investors before they engage in new portfolio management activities in the fall. Over Spring Break, we travel to New York City to meet with investment professionals at close to a dozen firms. Some classes attend Berkshire Hathaway’s annual meeting. And, of course, we tour the floor of the New York Stock Exchange and visit the famous charging bull on Wall Street! IMCP students also have the opportunity to travel to London to meet with investment managers.

Curriculum

Learn more about the IMCP curriculum and timetable here