Unlocking the Power of Interest: A Comprehensive Guide to Simple and Compound Interest

Introduction:

In the dynamic world of entrepreneurship and financial education, understanding the nuances of interest is paramount. Interest, a fundamental concept in finance, plays a crucial role in both personal and business finance. In this comprehensive guide, we will delve into the intricacies of simple interest and compound interest, exploring their definitions, formulas, and real-world examples.

Simple Interest:

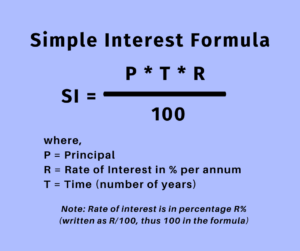

Simple interest is the most straightforward form of interest, calculated on the initial principal amount for a specific period. The formula for simple interest is given by:

Simple Interest (SI)= P*R*T/100

Where:

P is the principal amount,

R is the rate of interest, and

T is the time in years.

Example 1: Let’s say you invest $5,000 at an annual interest rate of 8% for 3 years. Using the simple interest formula:

Simple Interest = 5000*8*3/100

= $ 1,200

So, the simple interest earned over the 3-year period would be $1,200.

Interest rates play a crucial role in entrepreneurship, impacting decisions on borrowing and investment. For instance, when considering taking out a loan to fund business expansion, entrepreneurs analyze interest rates to assess the cost of capital. Lower rates can incentivize borrowing for growth initiatives, while higher rates may prompt strategic adjustments or delay borrowing. Additionally, understanding interest rates enables entrepreneurs to evaluate the feasibility of financing options, manage cash flow effectively, and make informed decisions to optimize financial resources for sustained business development.

Imagine Biswajeet, an entrepreneur, wants to expand his online retail business by purchasing new inventory. He considers taking out a business loan to finance the expansion. Biswa researches different loan options and interest rates offered by various lenders. If he finds a lender offering a low-interest rate, he can borrow the necessary funds at a lower cost, allowing his to invest more in inventory and potentially increase his profit margins. However, if interest rates are high, he might decide to delay expansion plans or explore alternative financing methods to minimize borrowing costs and maintain profitability.

Compound Interest:

Compound interest, however, incorporates interest earned on the principal amount and accumulated interest from previous periods. The formula for compound interest is given by:

Compound Interest (CI)= P*(1+R/100) ^T – P

Where:

P is the principal amount,

R is the rate of interest per compounding period, and

T is the total number of compounding periods.

Example 2: If you invest $5,000 at an annual interest rate of 8%, compounded annually for 3 years, the compound interest can be calculated as follows:

CI=$5,000(1+8/100)^3−$5,000

CI = $1298.50

So, the compound interest earned over the 3-year period would be approximately $1,298.50.

Why Compound Interest is Called the 8th Wonder of the World:

The renowned physicist Albert Einstein is often attributed with calling compound interest the “8th wonder of the world.” The power of compound interest lies in its ability to generate earnings not just on the initial principal amount but on the accumulated interest as well. This compounding effect can result in exponential growth over time.

Consider this: as interest compounds, each period’s interest becomes a part of the principal for the next period, creating a snowball effect. Over extended periods, the growth can be astounding, turning a modest investment into a substantial sum.

In essence, the longer the money is allowed to compound, the more powerful and significant the impact becomes. This compounding phenomenon is what led Einstein to express his awe at the seemingly magical and unparalleled force that is compound interest.

Conclusion:

In the realm of entrepreneurship and financial education, a solid understanding of interest is indispensable. Whether you opt for the simplicity of simple interest or harness the power of compound interest, these financial tools can be instrumental in making informed decisions about investments, loans, and wealth creation. As you navigate the intricacies of interest, remember that knowledge is the key to financial empowerment and success. Embrace the power of compound interest, the 8th wonder of the world, and let your financial endeavors flourish.