Each year taxpayers can fall victim to scams. Though they can occur at any time, scams tend to peak during tax filing season. Educate yourself about what’s out there and take steps to protect yourself and your tax data.

- Please note that the Internal Revenue Service (IRS) will never contact you via email. If you receive such an email, do not open it as it likely contains some sort of virus or malware.

- You should never provide your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) to anyone through email.

- Also, the GLACIER Support Center will never ask you to send your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) via email, and you should never include it when sending in a support email.

IRS Tips

![]()

UWM Information Security

Major Tax Scams

Phishing

Phishing is a scam where criminals attempt to steal your financial information through the use of email or a fake website. In many cases, the bogus emails ask for specific personal information or try to get you to click on a link to install spyware or other malware on your computer. If you receive an unsolicited email that appears to be from the IRS, you can report it by forwarding it to phishing@irs.gov. Also be careful with emails purporting to be from individuals or companies asking for personal or payroll information (like this one making the rounds). When in doubt, assume it’s a scam.

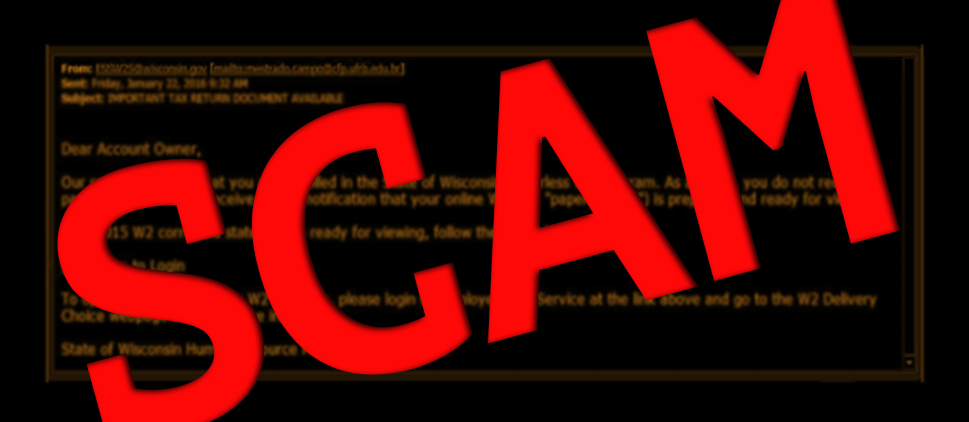

UW Service Center Communications Phishing Scam

In 2016 it came to our attention that some UW employees have received an e-mail as shown in the picture.This is a phishing attempt and not a legitimate e-mail. Do not click on the link provided. If you have clicked on the link, please contact the UWM Help Desk immediately. W-2s for all UW employees are distributed electronically through my.wisconsin.edu. Do not go to any other source for an electronic copy of your employee W-2.

Refund Email Scams

There are several variations of the refund scam, in which an e-mail claiming to come from the IRS falsely informs the recipient that he or she is eligible for a tax refund for a specific amount. The fraudulent e-mail instructs the recipient to click on a link to access a refund claim form. The form requests personal information that the scammers can use to access the e-mail recipient’s bank or credit card account. This notification is phony. The IRS does not send unsolicited e-mail about tax account matters to taxpayers. Filing a tax return is the only way to apply for a tax refund; there is no separate application form. Taxpayers who wish to find out if they are due a refund from their last annual tax return filing may use the “Where’s My Refund?” link at the only official IRS web site: https://www.irs.gov.

Phone Scams

Callers posing as agents from the IRS attempting to collect tax debts. Typically, callers posing as IRS representatives say the victims owe money and then threaten arrest if the amount is not paid immediately. Scammers will use fake names and IRS badge numbers and “spoof” or imitate the IRS toll-free number on caller ID to make it appear that it’s the IRS calling. If you get a phone call from someone claiming to be from the IRS and you’re not sure, and you have a legitimate tax issue outstanding, call the IRS directly at 1(800) 829-1040. If you get a phone call from someone claiming to be from the IRS and you know you don’t owe taxes, report the incident to the Treasury Inspector General for Tax Administration (TIGTA) at 1(800) 366-4484. For more information about IRS-related scams, click here.

Identity Theft

Identity theft, when someone uses your personal information such as your name, Social Security number (SSN) or other identifying information, without your permission, is often used by scammers to fraudulently file a tax return and claim a refund. The IRS has new protections for taxpayers this year including increased screenings, delayed refunds, and verification codes on some forms W-2. If you believe you are at risk of identity theft due to lost or stolen personal information, contact the IRS Identity Protection Specialized Unit at 1(800) 908-4490 or visit the IRS’ special identity protection page.

Return Preparer Fraud

Nearly two-thirds of taxpayers rely on professional tax preparers to assist them with their returns. Most tax preparers are good people, but some unscrupulous preparers may try to encourage taxpayers to claim improper credits, deductions or exemptions in hopes of boosting refunds. Use care when choosing a preparer and remember that taxpayers should use only preparers who sign the returns they prepare and enter their IRS Preparer Tax Identification Numbers (PTINs). You can review the IRS list of preparers with PTINs here. For questions to ask when hiring a tax preparer, click here. For information on red flags to avoid when choosing a tax preparer, click here.

Fake Charities

Watch out for groups masquerading as charitable organizations to attract donations from unsuspecting contributors. Bona fide charitable organizations have, as their mission, to benefit the public. Fake charities take advantage of taxpayers’ good nature to steal your money and potentially, your identity. To avoid being taken advantage of, donate to recognized charities using check or credit card where possible. Remember that you don’t need to give out personal information, like your Social Security Number, for the purpose of obtaining a receipt for your charitable donation. The best documentation on your end is a canceled check or credit card receipt so donate using those means on secure sites whenever possible. For more tips on making your charitable deduction count, click here.