If you are registered for the spring semester, tuition (and housing if you are living on campus) charges should already be reflected on your PAWS account. Until that time, pay attention to the fact that you may have anticipated aid for Spring 2020—but no charges yet. Soon you’ll be able to see a future balance due, and you’ll likely have some questions. Here are some of our FAQs!

[expand title=”What do I owe?”]

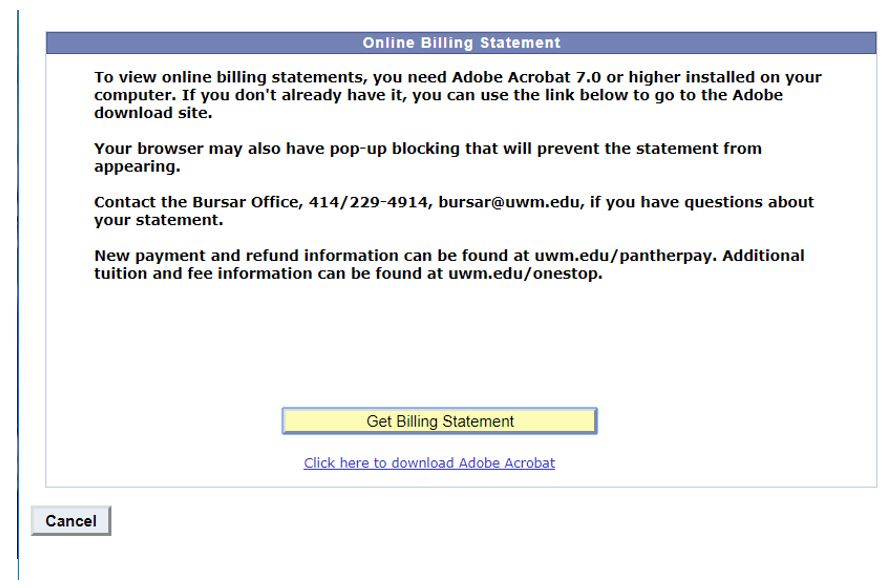

You will be sent an email and a bill from the Bursar Office with details on spring payment. Please read these carefully. Billing statements for spring will also be viewable on PAWS for all registered students.

It is very important that you select “View Billing Statement” (shown below) which takes into account anticipated financial aid. DO NOT SIMPLY LOOK AT THE ACCOUNT SUMMARY.

- If the amount of anticipated aid is LESS than the amount owed, you will have a balance due the university. As long as you have anticipated aid of at least $100, or made a minimum payment of $100 or more, any balance due after January 21 will then be moved to the Installment Payment Plan. Once the balance is moved to the Installment Plan, you will have two new due dates— February 20 and March 20. That will happen (approximately) January 23.

- If you will have a credit balance (i.e. you owe less than your anticipated aid), you do not need to make a payment; just confirm all of your aid disburses. Financial aid disbursement begins January 11.

In some instances, you may appear to have a credit balance, but this may not be the case. Sometimes, not all charges appear at once. Once all charges are posted (tuition, housing, and meals if applicable) you may owe the university. Any amount owed can be paid using the Installment Payment Plan. Billing/payment plan questions should be directed to the Bursar Office: (414) 229-4915.

[/expand]

[expand title=”What if I don’t have any anticipated aid showing?”]

You should read the Financial Aid PAWS Tutorial for help reviewing your PAWS account including ‘To Do Items and Accepting Aid.” If you haven’t applied for aid, it isn’t too late. Apply online at www.fafsa.gov. If you don’t have any anticipated aid, you will want to make the $100 minimum payment in order to participate in the installment plan and avoid possible late fees.

[/expand]

[expand title=”When will my aid disburse?”]

Financial aid disbursement begins Saturday, January 11, ten days before classes begin. You should be able to see disbursed aid posted on your PAWS account that afternoon. Our office will send you an email the following week either confirming your aid has disbursed or explaining why it has not. We will also send emails prior to January 11 to those who may experience a delay in their disbursement.

Beginning the week before the first disbursement, call volume in our office is extremely high. You may experience difficulty in speaking with a financial aid representative. The easiest way to verify your funds have disbursed is by checking your PAWS account and reading any email sent to your UWM account. If you do not see any To Do items in your PAWS account, and do not fall under one of the categories below, you should assume your aid will disburse on time.

If you are expecting an excess cash check, please make sure that your mailing address on PAWS is correct. The Bursar Office will begin mailing these on Tuesday January 14. They are unable to hold checks for pickup.

[/expand]

[expand title=”What could prevent my aid from disbursing?”]

Even when disbursement runs smoothly, some students experience delays in receiving their funds. The most common problems are listed below:

ENROLLMENT vs. FINANCIAL AID BUDGET:

- These must match in order for funds to disburse. All original financial aid offers are based on the assumption of full-time enrollment. If you are an undergraduate student planning to enroll for less than 12 credits or a graduate student taking less than 8 credits, you must tell us how many credits you will take. Our office will review your aid for possible revisions and make sure these match which then allows your aid to disburse. In most cases, a minimum of six undergraduate credits or four graduate credits is required to receive any amount of financial aid. If you have not previously provided our office with this information, please do so now. The most efficient way to inform us is via email or our online contact form. Please provide the number of credits you will take. Include ENROLLMENT or CREDIT LEVEL in the subject line and also make sure you include your Campus ID # in the body of your email.) Failure to notify our department by January 2 may result in a delay in the disbursement of your aid.

ALL LOANS REQUIRE A PROMISSORY NOTE:

- FEDERAL DIRECT LOAN MASTER PROMISSORY NOTE (MPN) and ENTRANCE LOAN COUNSELING: Both are required for these types of funds to disburse. If this is your first time receiving one of these loans, you will need to complete a MPN (which is the actual loan application.) First-time borrowers are also required to complete Entrance Counseling (a tutorial and quiz.) Both of these requirements can be satisfied online at https://studentaid.gov/. If you need to do either, you should see them reflected as a ‘To Do Item” on your PAWS account.

- NURSING LOANS): A new promissory note is needed each year. If one is needed, you should see it as a TO DO item in your PAWS account.

HOLD PLACED ON DISBURSEMENT PENDING VERIFICATION OF MAKING SATISFACTORY ACADEMIC PROGRESS:

- If you are on academic or financial aid probation or warning status, or on an academic plan, we need to confirm that you are meeting the requirements to continue. This review is generally not completed until closer to the start of the semester.

[/expand]

[expand title=”What else do I need to know?”]

If you change your enrollment level after your aid disburses, an adjustment to your award may be required. For details, please refer to the “Census Date” section of the online version of the 2019-20 Financial Aid Handbook. Now would be a good time to review the entire handbook for important and timely information.

Ask Pounce allows you to submit your questions 24/7 and most questions will be answered immediately. You can contact us by phone, email, or in-person as well. Advisors are available to assist with more complex issues via phone as well as in-person. You can schedule your own appointment or call us in advance to schedule one for you. Otherwise, Financial Aid Advisors will be available without appointments, on a walk-in basis:

January 13-17, 2020

Monday, Wednesday, Thursday: 10:00 am – 4:00 pm

January 20-24, 2020

Monday: Office Closed

Tuesday-Friday: 10:00 am – 4:00 pm

Extended Advising Hours (4:00 pm – 5:30 pm) available on the following dates:

Monday, January 13

Tuesday, January 21

Walk-in Wednesdays will take place throughout the entire semester!

After the beginning of the semester, walk-in advising will continue on Wednesdays only. Advisors are available between the hours of 11:00 am and 3:00 pm. See all of our contact information here.

[/expand]