A key date is approaching for students looking for help to pay for college tuition this fall.

And for UWM seniors scheduled to graduate in May, it’s time to start thinking about financial planning after earning their diploma, too.

Either way, it’s never too early to start getting ready for the future, said Rebecca Neumann, a UWM professor of economics who teaches about financial literacy in the classroom. She also teaches students and advises the board at SecureFutures, a nonprofit that provides financial literacy programs to empower students to make sound financial decisions.

First, let’s begin with students either planning to start college in the Fall 2022 semester or continuing students returning in September.

The sooner the better

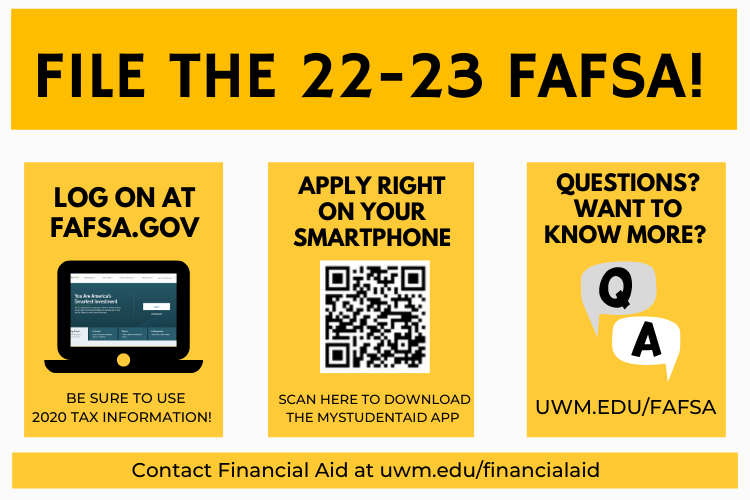

Most colleges and universities recommend that the 2022-23 Free Application for Federal Student Aid (FAFSA) be completed no later than March 1, 2022, in order to enroll in Fall 2022. Filling out the form unlocks opportunities to access grants, scholarships, loans and other forms of aid to help pay for higher education.

“The sooner it’s completed the better, as some financial aid funds are limited and schools award on a first-come, first-served basis,” said Timothy Opgenorth, director of financial aid at UWM.

Most institutions started sending initial estimates of financial aid awards, including federal aid, in January or February to new students enrolling in Fall 2022. Those awards are finalized later in the spring, usually in May, after Congress passes the federal budget.

“This allows students and/or parents to discuss and line up other funding to ensure the bill is covered by the time the semester starts,” Opgenorth said.

Financial aid awards for current students returning for Fall 2022 will begin to be processed in early to mid-April.

Financial wellness classes important

While enrolled in college, students should look into taking an economics class that focuses on financial wellness and digs deeper into personal finance topics such as money management, establishing credit and saving or investing for the future. At UWM, that class is Econ 110, the Economics of Personal Finance.

For college seniors getting ready for life after graduation, planning should start with writing down a budget, which is a plan for income, expenses and savings, according to Neumann.

“Plan for how you are going to allocate your paycheck. Saving early and right away can get you in the habit,” Neumann said. She recommended incrementally adding more money to savings as pay increases over time.

“Putting this money away before you become accustomed to using it can mean larger gains through the power of compound interest,” she added. “Tracking cash flow can help you determine your future plan, adjusting your plan as your income and expenses change.”

More tips

Other tips for college seniors graduating this spring:

- Allocate some savings to an emergency fund that is accessible (for instance, a savings account instead of a retirement account) to provide a financial safety net in case of an unplanned expense.

- If you have student loans, take time to understand repayment options to find the one that is right for your situation. Those working in the public sector or teaching in a low-income school may be eligible for loan forgiveness.

- Periodically revisit your budget and adjust spending and saving to reflect changes in your life.

- Keep long-term goals, like a house, further education or even retirement, in mind for longer-term saving.

“But also remember to allocate some funds for current expenditures that give you joy!” Neumann said.