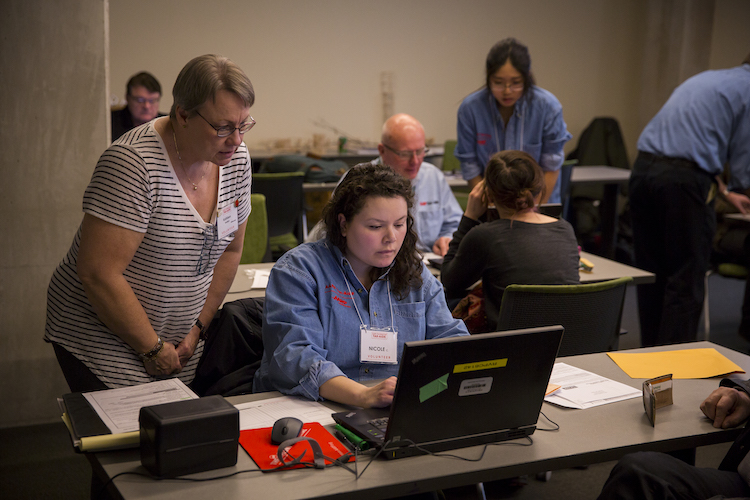

The client needed assistance getting those pesky taxes filed, and Meng Liu was there to make it happen. Liu ran down what credits and exemptions the woman could claim, which ones weren’t worth pursuing, and how to get all the paperwork properly filled out.

By the end of that Feb. 6 meeting, the client’s taxes were ready to file. And you’d have never known Liu was not a seasoned tax accountant, but still a senior accounting major at the University of Wisconsin-Milwaukee.

Liu is one of several UWM accounting students partnering with AARP to offer free tax help at UWM’s Cambridge Commons, 2323 N. Cambridge. The assistance is available 9 a.m.-noon on select Saturdays through April 9, and no appointments are necessary. Students and neighborhood residents are welcome.

“I thought it would be a great experience for the students, giving them some time in the field and helping them solidify their understanding of tax law,” said Douglass Bartley, an accounting senior and former UWM chapter board member of the accounting honorary Beta Alpha Psi. About a dozen of the club’s members are volunteering their time, not only at Cambridge Commons, but also at the West Allis Senior Center.

AARP connected with the student accountants through Laurie Marks at UWM’s Center for Community-Based Learning, Leadership and Research. When an email about the project went around the Lubar School of Business, Bartley thought it was a perfect opportunity for Beta Alpha Psi.

“The students are doing an excellent job,” said Kathleen Swedlund, district coordinator for AARP and a Tax-Aide volunteer. AARP volunteers handle 60,000-70,000 returns every year, including about 6,000 at the organization’s Milwaukee-area sites. The service is geared to helping low-income residents, Swedlund said, but AARP does not discriminate by age or income.

It’s a mutually beneficial arrangement. While the accounting students are helping the community, Bartley said, they’re gaining insights into the real world of tax filing. And though students aren’t anticipating anyone bringing them a shopping bag full of receipts, they are prepared for a variety of individual tax challenges.

“We’re really excited,” Bartley said, “to be involved in this partnership.”